Hey frens, your friendly green blob back again. While the heat kept rising, Lazy Summer DAO kept shipping. July was a month of deeper strategy discussions, vault expansions, the SUMR token working group kickoff, and more.

Strap in for your governance highlights + DAO metrics.

Keep applying sunscreen and try to beat the leaderboard in the yield racer!!!

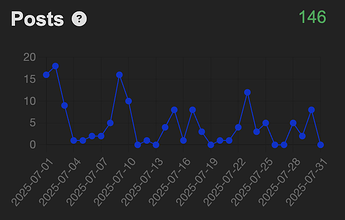

Let’s begin with an overview of the forum metrics:

A total of 146 posts were recorded. The overall trend suggests a growing and more active community participation (compared to June recap).

The Daily Active Users to Monthly Active Users ratio averaged 38%, indicating increased users engagement on any given day.

DAO Metrics:

| Parameter | June | July | Trend |

|---|---|---|---|

| Delegates | 507 | 510 | ↑ |

| SUMR Delegated | 343.25M | 348.96M | ↑ |

| DAO Treasury | $102,200 | $129,134 | ↑ |

| SUMR Holders | 4,614 | 4,927 | ↑ |

July saw continued growth in community engagement with an increase in delegates count (+3) and SUMR delegated (+5M), while the DAO treasury increased by $7K, as well as the number of SUMR holders rose by over 300, again.

Protocol Metrics:

| Chain TVL | June | July | Trend |

|---|---|---|---|

| Ethereum | $84.53M | $86.21M | ↑ |

| Base | $19.4M | $15.92M | ↓ |

| Arbitrum | $9.17M | $6.18M | ↓ |

| Sonic | $7.41M | $4.84M | ↓ |

| Total | $120.51M | $113.15M | ↓ |

Total TVL has seen a decrease in July, driven mainly by Base (-$3.5M), Arbitrum (-$3M), Sonic (-$3.4M), while Ethereum saw a slight increase (+$1.7M).

| Assets | June | July | Trend |

|---|---|---|---|

| ETH Pegged | $56.4M | $54.8M | ↓ |

| USD Pegged | $61.9M | $56.7M | ↓ |

| EUR Pegged | $2.1M | $3.2M | ↑ |

EUR-pegged assets continued to gain traction with a $1.1M increase, while USD-pegged assets decreased by over $5M, and ETH-pegged assets dipped by over $2M, reflecting the shift in user preferences, and risk appetite due to market conditions and temporary liquidity crunch in some of the vaults present.

NO USER FUNDS WERE AFFECTED!

*Certain protocols/strategies (ARKs) integrated had an withdrawal queue, which had to be fulfilled before instant liquidity was restored.

Notable RFCs:

- [RFC] Transfer Vault Rewards from staking to Merkl and enable tokenisation of Vault Shares (July 2nd)

published by @chrisb

Proposes transitioning vault rewards from the current staking system to Merkl (or a similar mechanism) to enable the tokenization of Lazy Vault shares, and future products like “Lazy Loops”.

- [RFC] SUMR token upgrade to allow for updated Governance Staking Module (July 3rd)

published by @chrisb

Proposes upgrading SUMR to an upgradeable token to support a new Governance Staking Module with features like lockups, variable rewards, and maintained voting power.

- [RFC] SUMR Transfer Readiness Working Group (July 8th)

published by @jensei

Proposes forming a community-led SUMR Transfer Readiness Working Group to deliver a clear, milestone-based roadmap for responsibly enabling SUMR token transfers.

- [RFC] Gauging Interest: RWA vaults for institutional allocators (July 9th)

published by @samehueasyou

Explores the feasibility and value of launching RWA Vaults within the Lazy Summer Protocol to attract institutional capital. These vaults would offer automated, diversified exposure to tokenized real-world assets.

- [RFC] Bitcoin, baby: Should Lazy Summer have a BTC Fleet? (July 9th)

published by @samehueasyou

Proposes launching a BTC Vault (Fleet) within Lazy Summer that earns yield through a delta-neutral cash and carry strategy using onchain tools like Hyperliquid.

- [RFC] Forum polls for proposal support signaling? (July 9th)

published by @rspa_StableLab

Proposes using forum polls as informal support signals for proposals on the Lazy Summer forum to offer a quick, transparent way to gauge community sentiment.

SIPs in Focus:

- [SIP2.17] Integration of Silo Mainnet - Apostro USDC Frontier (July 1st)

published by @halaprix

Proposes adding the Apostro USDC Frontier vault from Silo Finance to the Mainnet Lower Risk fleet, expanding single-asset USDC strategies with a competitive APR and SILO incentives.

- [SIP2.18] Integration of Silo Arbitrum - USDC Vault (July 1st)

published by @halaprix

Proposes onboarding the Silo USDC vault on Arbitrum to the Lower Risk fleet, adding a high-yield, cross-chain USDC strategy with attractive APR and SILO incentives.

- [SIP2.19] Integration of Silo Sonic - Greenhouse USDC (July 1st)

published by @halaprix

Proposes integrating the Greenhouse USDC vault from Silo Finance into the Sonic Lower Risk fleet, expanding earn-side offerings with a competitive APR and multi-token yield incentives.

- [SIP5.7] Raft Contract Upgrade to Support Auctions of ERC20 tokens reverting on selftransfers (July 10th)

published by @halaprix

Proposes upgrading the Raft contract across all chains (Base, Arbitrum, Mainnet, Sonic) to fix a bug preventing finalization of failed xSilo auctions.

- [SIP2.20] Add sUSDe Strategy to USDC Mainnet – Lower & Higher Risk Vaults (July 23rd)

published by @samehueasyou

Recommends integrating sUSDe into both the Lower and Higher Risk USDC vaults on Ethereum Mainnet.

- [SIP2.21] Adding Lido stETH ARM to ETH Higher Risk Strategy (July 23rd)

published by @pete

Suggests adding Origin’s stETH ARM vault to the Ethereum Mainnet Higher Risk vault. The ARM vault earns yield by arbitraging discounted stETH, redeeming it 1:1 for ETH via Lido’s withdrawal queue.

- [SIP5.8] SUMR TR-WG Charter (July 25th)

published by @jensei

This proposal formalizes the charter for the SUMR Transfer Readiness Working Group (TR-WG).

- [SIP2.22] Onboard Gauntlet USD Alpha to the USDC Base – Lower Risk Vault (July 25th)

published by @samehueasyou

Adding Gauntlet’s USD Alpha strategy to the USDC Base Lower Risk vault.

- [SIP5.9] Upgrading AdmiralsQuarters contracts on all chains to support Merkl claiming (July 30th)

published by @halaprix

Upgrades the AdmiralsQuarters contracts across all chains (Base, Arbitrum, Mainnet, Sonic) to support Merkl reward claiming. It also requests that the new contracts be granted the required

ADMIRALS_QUARTERS_ROLE.

- [SIP5.10] Whitelist multiple addresses on SUMR token for MERKL reward transfer and other rewards (July 30th)

published by @chrisb

Whitelists key addresses on the SUMR token to prepare for the transition of vault rewards to Merkl. It includes Merkl-related contracts needed for distribution and campaign setup, as well as an additional address for distributing SUMR.

Tally Votes:

Published (July 2nd) /

Passed & Executed

Published (July 2nd) /

Passed & Executed

Published (July 2nd) /

Passed & Executed

Published (July 2nd) /

Passed & Executed

Published (July 2nd) /

Passed & Executed

Published (July 2nd) /

Passed & Executed

Published (July 10th) /

Passed & Executed

Published (July 30th) /

Passed & Executed

Published (July 30th) /

Passed & Executed

Published (July 30th) /

Passed & Executed

Published (July 30th) /

Passed & Executed

Get Involved:

Catch full details and join ongoing discussions on the forum and governance dashboard:

-

Discord: https://discord.com/invite/summerfi

-

Forum: https://forum.summer.fi

-

Onchain Governance: https://gov.summer.fi

-

DAO Dashboard: https://dune.com/lazysummer/lazy-summer-dao-governance

-

Protocol Dashboard: https://dune.com/lazysummer/lazy-summer-protocol

-

Token Dashboard: https://dune.com/lazysummer/sumr-claims

Shout out all the @Recognized_Delegates for doing the work!

See you on the Discord or Forum;

–jensei