Hey frens, your friendly green blob reporting back after another month of governance and building. August was packed with progress: loads of new ARKs (strategies) proposed and executed, Fluidkey integration went live, SUMR @TR-WG shared important notes, and the DAO treasury reached new highs.

Grab your sunglasses, here is your August recap of governance highlights & Lazy Summer DAO metrics.

Don’t forget to hydrate, and if you haven’t yet, check out the Fluidkey x Lazy Summer Protocol integration here!!!

Let’s begin with an overview of the forum metrics:

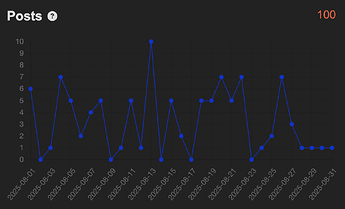

A total of 100 posts were recorded in August, down from July’s activity but still showing consistent governance discussions.

The DAU/MAU ratio averaged 30%, slightly lower than July (38%), suggesting that while participation is steady, daily activity dipped a bit compared to the hotter July debates.

DAO Metrics:

| Parameter | July | August | Trend |

|---|---|---|---|

| Delegates | 510 | 514 | ↑ |

| SUMR Delegated | 348.96M | 353.62M | ↑ |

| DAO Treasury | $129,134 | $159,825 | ↑ |

| SUMR Holders | 4,927 | 5,046 | ↑ |

Delegate count climbed by +4 and delegated SUMR grew by almost 5M, showing ongoing confidence in Lazy Summer governance. The treasury crossed the $150K mark, adding ~$30K in a single month. SUMR holders rose by over 100, sustaining steady community growth.

Protocol Metrics:

| Chain | July | August | Trend |

|---|---|---|---|

| Ethereum | $86.21M | $114.27M | ↑ |

| Base | $15.92M | $21.96M | ↑ |

| Arbitrum | $6.18M | $6.39M | ↑ |

| Sonic | $4.84M | $6.01M | ↑ |

| Total | $113.15M | $148.61M | ↑ |

Total TVL surged by $35M in August, driven primarily by Ethereum (+$28M) and Base (+$6M). Every chain saw growth.

| Asset Type | July | August | Trend |

|---|---|---|---|

| ETH-pegged | $54.8M | $82.85M | ↑ |

| USD-pegged | $56.7M | $65.92M | ↑ |

| EUR-pegged | $3.2M | $3.54M | ↑ |

ETH-pegged assets soared (+$28M), USD-pegged climbed +$9M, and EUR-pegged continued its steady growth with +$0.3M. This mix shows a broad expansion across all asset types, which is great to see.

Notable RFCs:

- [RFC] Onboarding infiniFi siUSD into Summer.fi USDC mainnet vault (August 1st)

published by @Valbpereira

Proposes adding siUSD, the staked version of infiniFi’s iUSD, to Lazy Summer Protocol USDC Mainnet Lower Risk vault.

- [RFC] Onboard USDC and ETH Fleet - Optimism Mainnet (August 12th)

published by @MasterMojo

Proposes exploring USDC and ETH vault deployment on Optimism Mainnet using Moonwell, Aave, and Sky as yield sources. It also suggests pursuing Optimism Growth Grants to support the launch.

- [RFC] SUMR TR-WG Checklist (August 20th)

published by @rspa_StableLab

This RFC introduces a comprehensive readiness checklist developed by the Transferability Working Group to guide SUMR’s transition to being transferable.

SIPs in Focus:

- [SIP3.6] Delegate Rewards Distribution (July) (August 1st)

published by @jensei

Authorizes the distribution of 148,999.97 SUMR from the DAO Treasury to compensate active delegates for their governance participation in July 2025.

- [SIP2.23] Onboard Gearbox USDC curated by Invariant – Higher Risk Vault (August 1st)

published by @desnakeee.eth

Adds the Gearbox USDC Pool, curated by Invariant, to the USDC Higher-Risk Vault on Ethereum mainnet.

- [SIP5.5.1] July Payouts for Referral Campaign (SIP5.5) (August 5th)

published by @chrisb

Outlines the July 2025 payouts for the previously approved referral campaign (SIP5.5), distributing 19,053.77 SUMR and 687.48 USDC to 226 participants on Base.

- [SIP3.7] Enable MERKL Rewards on all vault markets (August 8th)

published by @chrisb

Moves vault rewards from Lazy Summer staking contracts to MERKL, enabling transferable and composable Vault Tokens across DeFi.

- [SIP2.24] Update ARKs from core protocols on mainnet fleets (USDC/WETH/USDT) (August 12th)

published by @samehueasyou

Adds a wide set of new strategies from Morpho, Euler, and Silo to the USDC, WETH, and USDT vault fleets on Ethereum Mainnet.

- [SIP2.25] Update ARKs from core protocols on Base fleets (USDC/WETH) (August 12th)

published by @samehueasyou

Adds new Morpho and Euler strategies to the USDC and WETH vault fleets on Base.

- [SIP2.26] Update ARKs from core protocols on Arbitrum fleets (USDC/USDT) (August 12th)

published by @samehueasyou

Adds new Morpho, Euler, and Silo-managed strategies to the USDC and USDT vault fleets on Arbitrum.

- [SIP2.27] Full Support for Morpho ARKs on Arbitrum (August 12th)

published by @samehueasyou

Adds all live Morpho vaults (USDC, USDT, WETH) on Arbitrum to maximize yield access.

- [SIP3.8] Governance Staking Rewards extension (August 18th)

published by @Baer_DAOplomats

Recommends a 40-day extension of the existing governance staking rewards for SUMR tokens on Base.

- [SIP2.28] Onboard Gearbox USDC curated by Tulipa Capital – Higher Risk Vault (August 18th)

published by @desnakeee.eth

Recommends adding the Tulipa Capital Gearbox USDC Pool as a new ARK in Lazy Summer Protocol’s USDC Higher-Risk Vault on Ethereum Mainnet.

- [SIP2.29]: Onboard Gearbox cp0xLRT Pool - ETH Higher Risk Vault (August 26th)

published by @cp0x

Seeks to add the Gearbox cp0xLRT wstETH v3 pool as a new ARK strategy in the Lazy Summer Protocol ETH Higher Risk Vault on Ethereum Mainnet.

- [SIP5.11] Multi-Chain Fleet Token Transferability Enablement (August 27th)

published by @chrisb

Enables token transferability for all active Fleet Commanders across Base, Arbitrum, Mainnet, and Sonic, aligning with the protocol’s move to Merkl-based rewards (SIP3.7).

Tally Votes:

Published (August 6th) /

Cancelled

Published (August 6th) /

Passed & Executed

Published (August 6th) /

Passed & Executed

Published (August 8th) /

Passed & Executed

Published (August 13th) /

Passed & Executed

Published (August 13th) /

Passed & Failing to Execute

Published (August 13th) /

Cancelled

Published (August 13th) /

Passed & Executed

Published (August 13th) /

Passed & Executed

Published (August 13th) /

Passed & Executed

Published (August 20th) /

Passed & Executed

Published (August 20th) /

Cancelled

Published (August 20th) /

Passed & Executed

Published (August 27th) /

Passed & Executed

SUMR Transfer Readiness Working Group:

The SUMR @TR-WG contributors shared two insightful contributions:

- Tech & Protocol - Gov v2 (90% done, as reported by @halaprix): removing vote decay & simplifying participation. New staked SUMR (xSUMR/sUMR) coming soon with robust staking contracts.

- Tokenomics & Liquidity - Liquidity plan v0.1 (reported by @TokenBrice): targeting $1M TVL in SUMR//ETH/USDC pools via POL + incentives. Partnerships [OETH, BOLD, Aerodrome] explored to strengthen launch liquidity.

Together, these notes mark strong progress toward preparing SUMR for the next phase; enabling the transferability → Late Sep - Early Oct, 2025 (according to the checklists tentative timeline)

Get Involved:

Catch full details and join ongoing discussions on the forum and governance dashboard:

- Discord: Summer.fi

- Forum: https://forum.summer.fi

- Onchain Governance: https://gov.summer.fi

- Calendar: Notion

- DAO Dashboard: https://dune.com/lazysummer/lazy-summer-dao-governance

- Protocol Dashboard: https://dune.com/lazysummer/lazy-summer-protocol

- Token Dashboard: https://dune.com/lazysummer/sumr-claims

Shout out all the @Recognized_Delegates for doing the work!

See you on the Discord or Forum;

–jensei