TL;DR

-

Mission: Deliver DeFi’s best risk-adjusted yields, automatically. Current self-grade 7.5/10 , can be 10/10.

-

Why now: >$10k cohort holds ~$300M off-protocol (Plasma ~$170.2M, Linea ~$62.3M, HyperEVM/Hyper ~$57.2M). Users also choose Aave on mainnet despite lower yields → protocol is missing demand pockets.

-

Four growth vectors

- Assets: Create a BTC vault on mainnet first (evaluate YieldBasis, EdgeBTC/UltraYield, Morpho wBTC).

- Yield Sources: Start a Monthly/Weekly Yield Review and public backlog; aim for top-5 yield on aggregators. Onboard new arks.

- Networks: Create an Emerging Network Tier (ENT) to deploy to networks with lower yield but high growth potential. Onboard Hyperliquid (USDC/USDT/USDH) now; reassess Linea/Plasma; pre-stage MegaETH/Monad.

- Understand how to align with tailwinds (RWAs, stables, fixed rates).

-

Immediate asks (future SIPs):

- Approve BTC vault (mainnet v1; caps + risk playbook).

- Adopt ENT policy (faster new-chain onboarding with guardrails).

- Launch the Yield Review cadence (and pre-onboard listed strategies). Onboard missing ARKs.

- Deploy to Hyperliquid; decision point on Linea/Plasma; pre-stage Monad/MegaETH.

Lazy Summer’s mission is simple: give users access to DeFi’s best risk-adjusted yields. On that mission, I’d grade us 7.5/10 today. Good, not yet the best in the world. This RFC lays out several actions and initiatives to unlock growth.

Please note, growth does not always mean doing more stuff. Even though these initiatives focus on **adding more and doing more.I believe that subtraction, and simplification of the core value for users is also key. But that is for another time.

Four vectors of growth

- Supported Assets: Add BTC (first) and tighten asset coverage where user demand is obvious.

- Yield Sources: Formalize a monthly yield review + backlog; ship missing top strategies quickly.

- Network Support: Onboard Plasma, HyperEVM, Linea now; create an Emerging Network Tier to move faster on new chains (Monad, MegaETH, etc.).

- Positioning & Awareness: Be The Only place users check for the best yields; ensure Lazy vaults appear at the top of aggregator rankings consistently.

Give users what they want

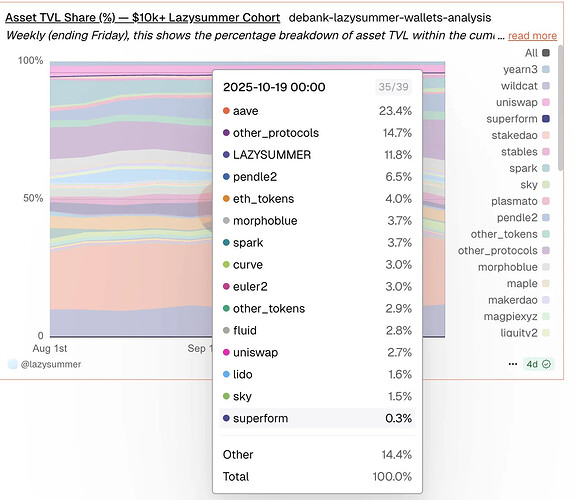

Lazy Summer consistently captures around 10% of total wallet TVL, with its share highest among larger cohorts, where users with $3M+ historical TVL allocate up to 20% or more to the protocol.

Lets assume that the max any user would allocate to a yield strategy is 75% of their their assets, still, why do Lazy Summer users allocate any assets to other protocols, chains or strategies if we give users access to DeFi’s best risk adjusted yield, automatically. Does not make sense.

Non negligible Lazy Summer users (>$10k depositors) hold ~$300M outside Lazy Summer across Plasma ($170.2M), Linea ($62.3M), and HyperEVM/Hyper (~$57.2M). All chain that Lazy Summer has no presence***, why?***

When it comes where the majority of capital is (Ethereum), users opt for AAVE, a protocol with substantially lower yields. This could be because AAVE facilitates a majority of yield loop demand.

This, to me, this data makes the growth vectors mentioned clear. Support the right assets, get on the chains with thriving ecosystems (of potential for thriving ecosystems), be sure to always have the highest quality yields - no exceptions, Position appropriately and ride market tail winds to mass awareness.

1. Supported assets, add a BTC vault

Among non stables, ETH, BTC, SOL dominate user interest. SOL’s architecture diverges, and USDe (Ethena) has technical constraints today. BTC is the cleanest path to unlock demand for Lazy Summer Protocol in the near future.

Specific future SIP request: Approve a BTC vault on Mainnet.

Initial yield sources to evaluate:

- YieldBasis (BTC basis strategies)

- EdgeBTC / UltraYield (BTC structured yield) and or other Edge Capital BTC vault strategies

- Morpho wBTC Markets

Rationale: Regardless of large amounts of BTC yield markets, the introduction of BTC vault sets up the protocol for success, and fast moving onboarding of ARKs in the future.

# 2. A more systematic approach to yield sources

The number one goal that our target users have is to get the best yields in DeFi. Lazy Summer often has these best in class yield sources, but it often does not.

Where is Lazy Summer ?

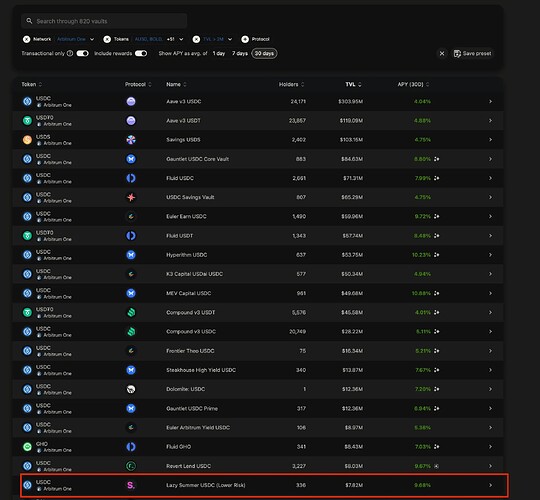

This means that for better or worse, our target customers still rely on yield ranking dashboards and curated lists from trusted, influential voices. (yields of the week, weekly stablecoin alpha, and calculator guy) In my view, there should be 0 demand for content of this kind because you should just deposit in summer.

How can Lazy Summer consistently be ranked among the top yields? never number one, because thats not risk adjusted, but always top 5.

Specific future SIP request: Implement a weekly process to incentive the curation and ranking of DeFi yields.

- Bi-Weekly public Lazy Summer community call that ranks DeFi wide yield sources

- This could also be done async. Though a call could also serve as a marketing tactic.

- Maybe it should be incentivized similar to delegation, maybe its a new role?

- Maybe this group should have a target APY per vault.

- Example: Vaults.fyi → TVL, Asset and Network filters → Rank by category → if top yields not in Lazy Summer, make sure its intentional. → draft RFCs

Rationale: An initiative of this kind ensures that Lazy Summer does not have to wait for yields to come to them. The protocol can be more proactive in finding the best yields and not falling behind.

Specific future SIP request #2: Onboard yield sources that are high ranking, but not supported on Lazy Summer.

I don’t think its a coincidence that some of Lazy Summer’s fastest growing vaults, are also on the front page of Vaults.fyi.

As such, Lazy Summer Protocol should onboard the following ARKs, prior to the first bi-weekly yield call.

Mainnet USDC

| Yield Source | Contract Address | Vault FYI lINK |

|---|---|---|

| Midas - Re7 Yield | Contract → | Vaults FYI → |

| Midas Hyperithm | Contract → | Vaults FYI → |

| Midas Farm | Contract → | Vaults FYI → |

| Upshift Gamma USDC | Contract → | Vaults FYI → |

| Midas Apollo Crypto | Contract → | Vaults FYI → |

| Midas mEDGE | Contract → | Vaults FYI → |

| Midas MEV | Contract → | Vaults FYI → |

| Frontier mAPOLLO | Contract → | Vaults FYI → |

| TelosC Stream | Contract → | Vaults FYI → |

| Morpho Alpha USDC Core | Contract → | Vaults FYI → |

| Upshift USDC | Contract → | Vaults FYI → |

| Upshift USDC Core | Contract → | Vaults FYI → |

| Clearstar USDC Reactor | Contract → | Vaults FYI → |

| Clearstar USDC Core | Contract → | Vaults FYI → |

Mainnet ETH

| Yield Source | Contract Address | Vault FYI lINK |

|---|---|---|

| WETH TelosC Stream | Contract → | Vaults FYI → |

| Eherfi Liquid ETH | Contract → | Vaults FYI → |

Base USDC

| Yield Source | Contract Address | Vault FYI lINK |

|---|---|---|

| High yield clearstar | Contract → | Vaults FYI → |

| 40Acres USDC Vault | Contract → | Vaults FYI → |

| Midas Basis Trading Token | Contract → | Vaults FYI → |

| Universal USDC | Contract → | Vaults FYI → |

| Clearstar USDC Reactor | Contract → | Vaults FYI → |

| Gauntlet USD Alpha | Contract → | Vaults FYI → |

| Frontier YO Market | Contract → | Vaults FYI → |

3. Network support for ecosystem’s with the potential to grow rapidly

Users deploy to emerging networks to chase early yield farming opportunities. This is especially common among larger users.

While this does not fit in our long term vision, I think its necessary to understand the motivation and user psychology that prompts them to go through the arduous task of bridging and deploying capital to a new, emerging network.

In that vein, the first step is to always be aware of new and emerging networks, which should not be hard given that they are usually rare and well telegraphed. These emerging networks should have their ****own section on the Bi-weekly Lazy Summer yield tracking.

Specific future SIP request #1: Create a new tier for Emerging Networks

I very much agree with @rspa_StableLab proposal about this.

- New tier would be explicitly be for users that want to deploy to new chains.

- This tier would have less of a mandate for best risk adjusted yield, and more about token farming new chain. (ie.. real yields on NewChain might be materially below any core Lazy Summer Vault, but would allow users to more easily get NewChain rewards.

- Bonus points for cross chain vault switch.

- Would set Lazy Summer protocol well for impending launches of Monad and MegaETH.

Rationale: Stops the bleed of large users who want to get into new chains. Also acts as an embedded marketing strategy when new chains go live to try to attract the demand.

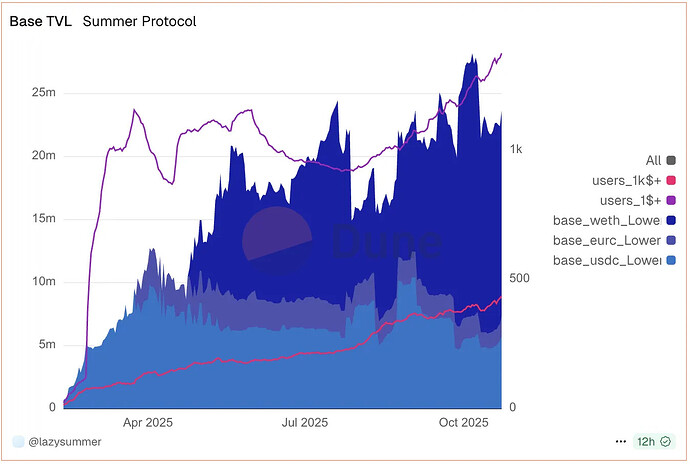

The next step is to deploy where the demand is and where the demand is going to be in the future.

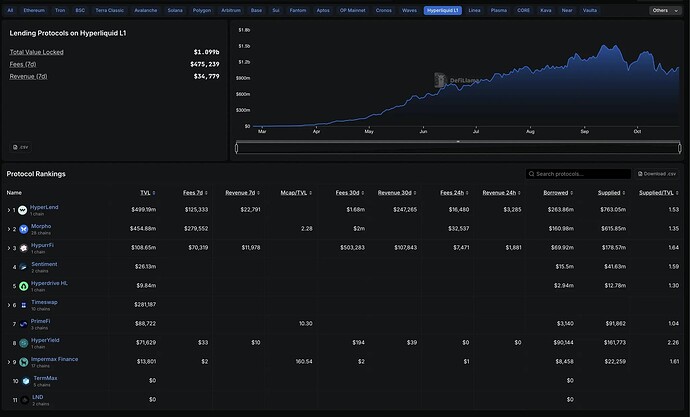

Hyperliquid’s yield ecosystem accounts for 1.1B in assets today, since April (43.2m) , that is a 61.1% monthly growth rate. At that pace, hyperliquids lending ecosystem will surpass the Solana, Base, Avalanche, and Arbitrum yield ecosystems combined, by the end of April 2026.

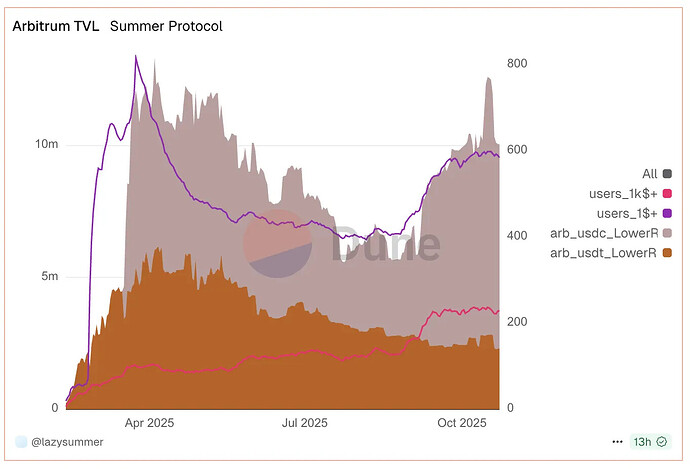

Contrast this with Plasma and Linea yield ecosystems which have seen stagnating growth.

Specific future SIP request #2: Deploy to new networks

- Onboard Hyperliquid USDC, USDT and USDH vaults.

- Assess the cost/benefit of deploying to Linea and Plasma. Both networks that have seen stagnating growth after rapid flashes of growth.

- Deploy to MegaETH and Monad (Both not launched yet)

Rational:

- A robust yield ecosystem for Hyperliquid

| Yield Source | What it is | Link to more info |

|---|---|---|

| HLP | HLP in the Hyperliquid ecosystem stands for Hyperliquidity Provider. It is a community USDC vault that provides essential liquidity for the Hyperliquid decentralized exchange (DEX) | More about HLP → |

| Hyperlend - USDC | HyperLend is a decentralized lending and borrowing protocol built natively on the Hyperliquid. | More about Hyperlend → |

| Hyeprlend - USDT | HyperLend is a decentralized lending and borrowing protocol built natively on the Hyperliquid. | More about Hyperlend → |

| Hyperliquiid User Vaults | Custom vaults created by traders or entities to share their own trading strategies. | More about hyper user vaults → |

| Felix USDT | Felix Vanilla Vaults are variable-rate lending pools on Hyperliquid, built using Morpho’s infrastructure, that let users lend or borrow assets like USDC, HYPE, and UBTC with floating interest rates based on utilization | More about felix earning → |

| Felix USDC | Felix Vanilla Vaults are variable-rate lending pools on Hyperliquid, built using Morpho’s infrastructure, that let users lend or borrow assets like USDC, HYPE, and UBTC with floating interest rates based on utilization | More about felix earning → |

| Felix USDH | Felix Vanilla Vaults are variable-rate lending pools on Hyperliquid, built using Morpho’s infrastructure, that let users lend or borrow assets like USDC, HYPE, and UBTC with floating interest rates based on utilization | More about felix earning → |

| USDH, USDC, USDT Hypurr | HypurrFi (Hypurr Lending) is a native decentralized lending protocol on the Hyperliquid ecosystem (specifically on HyperEVM), designed to offer advanced DeFi borrowing and lending | Learn about HypurrFi → |

| USDH, USDC, USDT Hypurr | HypurrFi (Hypurr Lending) is a native decentralized lending protocol on the Hyperliquid ecosystem (specifically on HyperEVM), designed to offer advanced DeFi borrowing and lending | Learn about HypurrFi → |

| Hyperbeat USDT | A DeFi layer inside Hyperliquid where users can earn, borrow, stake, and spend using on-chain tools designed for real-world adoption. | Learn more about Hyperbeat → |

| MorphoBeat USDC, USDT | The lending engine powering Hyperbeat — built on Morpho’s protocol — letting users borrow against assets (like HYPE, ETH, sUSDe) and earn yield via optimized vaults, all on Hyperliquid | Learn more about MorphoBeat → |

4. Positioning, awareness and tailwinds

Lazy Summer Protocol wins if users trust that Lazy vaults are the best way to access the best risk-adjusted yield across chains. To trust something you have to be aware of it, while some of the this will be addressed with media in the SUMR go to market Media Partner budget.

The main point that I want to address in this last vector of growth is more about longer term thinking. If Lazy Summer is going be the the best way to access the best risk-adjusted yield across chains, then the protocol will need to be relevant at least one of the major tailwinds in crypto.

- Real World Assets

- Institutional adoption

- Stablecoins

- Instituional adoption

- Fixed rates (Morpho v2, Pendle)

In this last grwoth vector section there is no future SIP, but I would like to open the space for these questions:

- In what ways, if any, can Lazy Summer Protocol benefit from growing demand for RWAs?

- In what ways, if any, can Lazy Summer Protocol benefit from growing demand for Stablecoins or yield bearing stables (ie.. LazyUSD - a best in class yield bearing stable wrapper?)

- In what ways, if any, can Lazy Summer Protocol provide users a better fixed rate lending experience? (ie - auto maturity roll as a form of rebalancing?)

- How can Lazy Summer benefit , if at all, from core upgrades to major protocols (Morpho v2, AAVE v4, Ethena White Label)