**Please note that this post is a reflection of my own thoughts as a Lazy Summer Community member, samehueasyou

TL;DR

- Initial focus (launch window, 1–2 months): 70% DeFi natives / 30% institutional. DeFi natives drive fast TVL and social proof, which then unlocks institutional credibility. Example: Morpho’s strong DeFi adoption preceded powering Coinbase Earn.

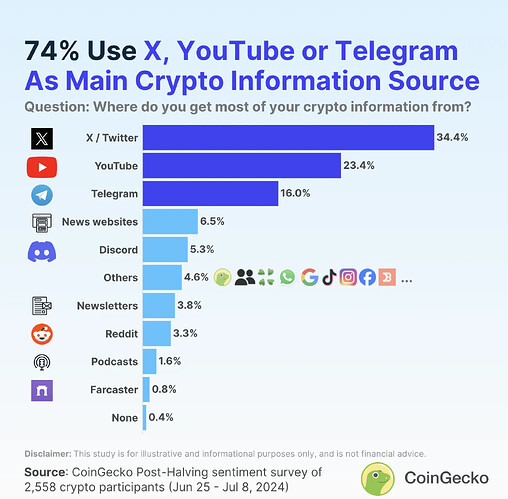

- Channels: For DeFi natives—X/Twitter, YouTube, and newsletters. For institutions—research-driven newsletters and media targeting allocators.

- Comp: Prefer SUMR tokens with 1–3 month lockups to align incentives and manage sell pressure.

- Benchmark: $40k spend → $2.5M TVL (62.5× dollar-to-TVL). Use this alongside conservative/base/aggressive scenarios.

An indepth response to @JC545 SUMR Transferability Go to Market: The path to 1b is 5x from here - #4 by JC545

Priority & Rationale

DeFi natives are not simply “retail”, many are sophisticated, 7–8 figure allocators with high technical and financial literacy. Winning this audience creates immediate TVL and buy pressure, plus the credibility institutions look for as they move through longer diligence cycles.

Plan: Launch with 70/30 DeFi Native to Institutional focus (This is only regarding SUMR Transferability marketing, not Lazy Summer Protocol roadmap), then flip toward institutional as TVL and credibility compound (target: 1–2 months post-transferability).

Where the audience is

- DeFi natives: X/Twitter (primary discovery), YouTube (long-form explainers, podcasts), and high signal newsletters.

- Institutions: Research-first newsletters and outlets consumed by funds, custodians, and large allocators.

~42% of crypto users calling X their main hub

Potential Media Partners

Below is a list of media entities (individuals and companies) that have DeFi native or Institutional audiences. They have been selected for brand alignment, that can help to spread the Lazy Summer Message. The list had been sorted by tier to help determine probability of partnership.

DeFi Natives

| Name | Tier | Twitter Reach | Youtube reach | Newsletter reach | Cost | Likely to accept tokens as compensation? |

|---|---|---|---|---|---|---|

| https://x.com/BanklessHQ | Tier 1 | 300k+ | Podcast network | 200k+ | 25k–100k+ | Unknown |

| https://x.com/Cointelegraph | Tier 1 | 2M+ | 150k+ | Multiple lists | 30k–150k+ | Unknown |

| https://x.com/CoinDesk | Tier 1 | 3M+ | N/A | 300k+ | 30k–150k+ | No |

| https://x.com/Blockworks_ | Tier 1 | 400k+ | Podcast network | 150k–250k | 20k–100k+ | No |

| https://x.com/DefiantNews | Tier 2 | 100k+ | 100k+ | 75k–100k | 5k–30k | Unknown |

| https://x.com/MilkRoadDaily | Tier 2 | 80k–100k | 20k+ | 250k–300k+ | 10k–40k | Unknown |

| https://x.com/MessariCrypto (Unqualified Opinions) | Tier 2 | 400k+ | N/A | ~300k | 15k–50k | No |

| https://x.com/Delphi_Digital | Tier 2 | 250k+ | 50k+ | 100k+ | 10k–40k | Unknown |

| https://x.com/thedefiedge | Tier 2 | 300k+ | N/A | 20k–40k | 5k–20k | Possible |

| https://x.com/therollupco | Tier 2 | ~50k | ~20k | Unknown | 20k | Yes |

| https://x.com/patfscott | Tier 2 | 90k | 55k | 30k | ||

| https://x.com/DeFi_Dad | Tier 2 | 175k | 55k | 15k | 20k - 50k | Maybe |

| Calculator Guy | Tier 2 | 115k | 65k | unknown | 20k | Yes |

| https://x.com/rektdiomedes | Tier 2 | 100k | n/a | 17k | unknown | Maybe |

| https://x.com/DefiIgnas | Tier 2 | 154k | n/a | 20k | unknown | maybe |

| https://x.com/ViktorDefi | Tier 2 | 80k | n/a | 7k | unknown | maybe |

| https://x.com/TheDeFinvestor | Tier 2 | 150k | n/a | |||

| https://x.com/MilkRoadDaily | Tier 2 ` | |||||

| https://x.com/cryptoslate | Tier. 2 | 90k | n/a | 110k | unknown | maybe |

| https://x.com/ournetwork__ | Tier 3 | 30k | n/a | 12k | unknown | maybe |

| https://defieducation.substack.com/ | Tier 3 | n/a | n/a | 44k | unknown | maybe |

Institutional

| Name | Tier | Twitter Reach | Youtube reach | Newsletter reach | Cost | Likely to accept tokens as compensation? |

|---|---|---|---|---|---|---|

| https://x.com/RealVision | Tier 1 | 300k–400k | 700k+ | Paid members | 30k–150k+ | No |

| https://x.com/Blockworks_ (Forward Guidance / Empire) | Tier 1 | 400k+ | Pod network | 150k–250k | 20k–100k+ | No |

| https://x.com/MessariCrypto (Research) | Tier 1 | 400k+ | N/A | 300k+ | 25k–100k+ | No |

| https://x.com/Delphi_Digital | Tier 2 | 250k+ | 50k+ | 100k+ | 10k–40k | No |

| https://x.com/BlockworksAdv | Tier 2 | 50k–100k | N/A | Paid research | 10k–30k | No |

| https://x.com/BlockworksRes (Blockworks Research) | Tier 2 | 50k–100k | N/A | Paid research | 10k–30k | No |

| https://x.com/BellCurvePod | Tier 3 | 50k–100k | N/A | n/a | 3k–15k | No |

| https://x.com/empire_pod (Empire) | Tier 2 | 50k–150k | N/A | n/a | 5k–25k | No |

| https://x.com/mementoresearch | Tier 3 | 9k | 5K | 5k | Maybe | |

| https://x.com/a1research__ | Tier 2 | 20k–50k | N/A | 4k | 10k–30k | Maybe |

| About - Serenity Research | Tier 2 | 10k | n/a | 9k | unknown | Maybe |

ROI Benchmarks & Spend to TVL Scenarios

Given the list of media entities reach and average cost, we can start to make some assumptions about return on investment. Previously, Stephen the Caluclaotr guy was engaged, resulting in about 2.5m in TVL.

Observed success benchmark: $40k → $2.5M TVL (62.5× dollar-to-TVL; ~1.6% marketing cost as % of TVL).

So, every $1 spent generated $62.50 of TVL, or equivalently, 1.6% marketing cost / TVL generated.

Scenario multipliers:

| Scenario | $1 : TVL | Mktg cost % of TVL | Notes |

|---|---|---|---|

| Conservative | 20× | 5.0% | Lower fit or weaker execution |

| Base | 40× | 2.5% | Solid performance |

| Aggressive | 62.5× | 1.6% | Matches benchmark |

Small budget ($10k–$75k)

| Spend | 20× Spend to TVL | 40× Spend to TVL | 62.5× Spend to TVL |

|---|---|---|---|

| $10k | $0.20M | $0.40M | $0.625M |

| $50k | $1.00M | $2.00M | $3.125M |

| $75k | $1.50M | $3.00M | $4.69M |

Medium budget ($100k–$250k)

| Spend | 20× Spend to TVL | 40× Spend to TVL | 62.5× Spend to TVL |

|---|---|---|---|

| $100k | $2.00M | $4.00M | $6.25M |

| $150k | $3.00M | $6.00M | $9.38M |

| $250k | $5.00M | $10.00M | $15.63M |

Large budget ($250k–$500k)

| Spend | 20× Spend to TVL | 40× Spend to TVL | 62.5× Spend to TVL |

|---|---|---|---|

| $250k | $5.00M | $10.00M | $15.63M |

| $400k | $8.00M | $16.00M | $25.00M |

| $500k | $10.00M | $20.00M | $31.25M |

Yuge bet the farm budget ($1M–$5M)

| Spend | 20× Spend to TVL | 40× Spend to TVL | 62.5× Spend to TVL |

|---|---|---|---|

| $1.0M | $20.0M | $40.0M | $62.5M |

| $2.5M | $50.0M | $100.0M | $156.25M |

| $5.0M | $100.0M | $200.0M | $312.5M |

Token caveat (important): Spend should be in SUMR with 1–3 month lockups. This aligns incentives and delays dilution, but introduces price volatility. Measure ROAS in USD equivalent at grant and track TVL retention post unlock.

Proposal

Given the sequence, channels, and audience. My proposal is simple:

Use SUMR tokens to compensate media partners to amplify the go to market message and launch. Spend as much as possible without posing risk to significant sell pressure of the token.

The big question

Of course, the big question here now is how much to spend such that TVL growth outweighs future sell pressure. I do not have the answer to that and it should be debated among the community.

Next Steps

- Outreach: Confirm partners willing to accept locked SUMR and define acceptable lock/vesting (e.g., 1-3 month cliff).

- Budget & Mix: Community sets token budget, lock terms

- Calendar: Coordinate content drops around launch moments

- Guardrails: Establish caps and contingency plans if token sell pressure risks exceed thresholds.