SummerFi Parameter Updates & Risk Assessment

We have made several parameter adjustments based on market conditions, risk assessment, and ongoing monitoring of deployed vaults. These changes optimize capital allocation while ensuring risk exposure remains controlled.

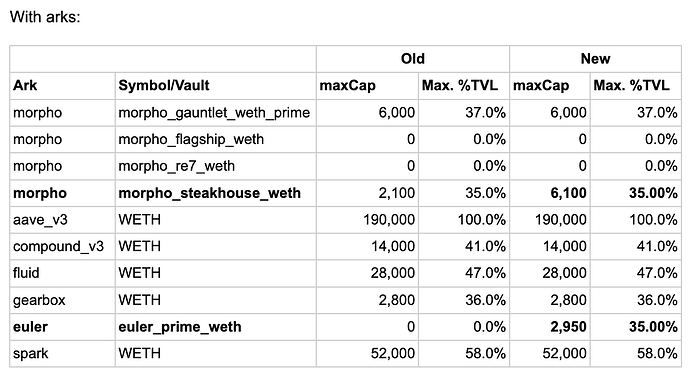

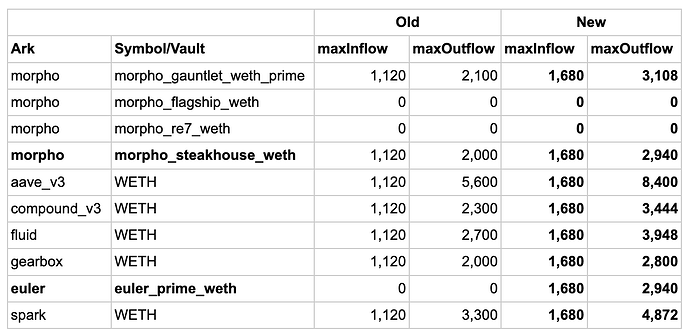

New Parameters - Fleet Mainnet - ETH

The Mainnet ETH fleet cap has been increased by 50%, as it was close to reaching its limit. Additionally, Euler Prime WETH has been activated on mainnet, as it meets the necessary risk criteria. We have also increased the cap for Morpho Steakhouse WETH, with further parameter adjustments to ensure it maintains a balanced risk-adjusted return. The new set of parameters are:

Other Arks

Following a review of arks Euler Yield USDT, Euler Yield USDC, and Stablecoin Maxi USDC, we decided to keep these at zero caps for now. Adding those ARKs would essentially introduce the exposure to the Usual Protocol to which, considering current Fleets and the ARKs onboarded, the Lazy SummerFi protocol has zero exposure at the time of writing this.

Usual protocol (USD0, USD0++, PT tokens of the underlying, etc.) introduces additional risk factors we are yet to be comfortable with at this stage.

Furthermore, we believe adding low caps would have little-to-no meaningful impact on fleet APY while still exposing us to an ecosystem with limited data. While they remain excluded for now, we will continue to assess them as additional data on Usual Protocol becomes available.

Execution of these updates will be done today, and we will continue to monitor the impact and adjust parameters dynamically as needed.

Cooldown Periods for Mainnet Vaults

To allow faster capital reallocation between Arks, the cooldown period on mainnet has been reduced from 3 hours to 10 minutes. This change increases flexibility in managing assets across fleets while ensuring capital flows efficiently to high-performing and lower-risk Arks.

Future Adjustments

As market conditions evolve, additional data emerges, and risk models improve, we will continue refining these parameters to ensure accuracy and efficiency. Future iterations may introduce dynamic liquidity adjustments, rehypothecation metrics, and adaptive weighting mechanisms to further optimize risk management across Arks and fleets.

Execution of these updates will be done today, and parameters will continue to be monitored and adjusted dynamically as needed.