Summary

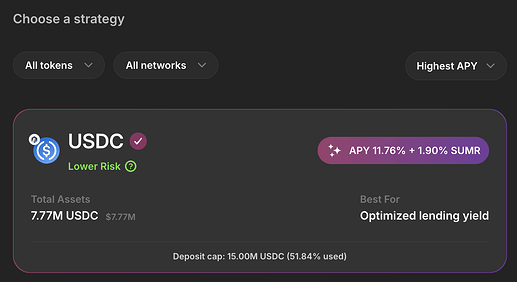

This SIP proposes integrating Hyperithm’s Morpho USDC Strategy into the USDC Arbitrum – Lower Risk vault within the Lazy Summer Protocol.

Following comprehensive technical review and risk diligence, the Hyperithm Morpho USDC Strategy aligns with Lazy Summer’s standards for inclusion. The strategy leverages Morpho’s institutional-grade Blue lending infrastructure to generate stable yield opportunities, while maintaining a lower risk profile compared to higher-risk DeFi yield strategies.

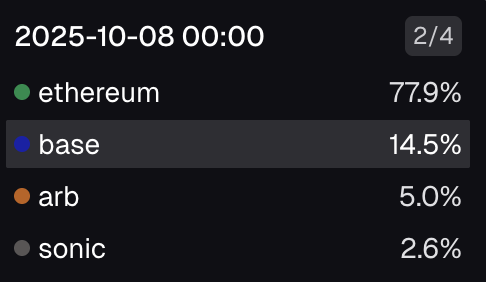

By adding this strategy, Lazy Summer’s vault offering is diversified across chains and gains exposure to Morpho’s efficient, liquidity-optimizing lending design, broadening Lazy Summer’s lower-risk product lineup.

Motivation

- Expand Yield Sources – Incorporates a proven Morpho Blue lending strategy on Arbitrum, adding institutional-grade yield opportunities to the Lower Risk vault family.

- Attract New Users – Appeals to conservative DeFi users, institutional investors, and liquidity providers seeking stable, lower-risk yield generation.

- Increase TVL – Supports Lazy Summer’s strategic objectives by strengthening the USDC vault lineup on Arbitrum with a distinct, Hyperithm-operated lower-risk strategy.

Specification.

| Parameter | Value |

|---|---|

| Vault | USDC Arbitrum – Lower Risk |

| Network | Arbitrum |

| New ARK | Hyperithm USDC (Morpho) |

| Contract Address | 0x4B6F1C9E5d470b97181786b26da0d0945A7cf027 |

| Risk Tier | Lower Risk |