Context / goal

Onboard additional ARKs to the USDC vault fleet on Arbitrum to maintain coverage of top Arbitrum stablecoin yield leaders.

Proposed ARKs

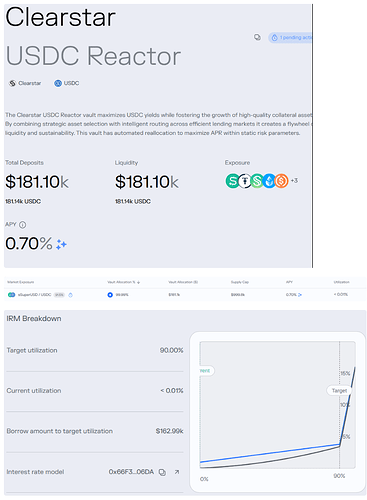

- Ark/Yield source: Clearstar USDC Reactor (Morpho Blue)

Risk: Low/Moderate (requested)

Links

App: https://app.morpho.org/arbitrum/vault/0xa53Cf822FE93002aEaE16d395CD823Ece161a6AC/clearstar-usdc-reactor

Contract: —

Vaults fyi: —

- Ark/Yield source: Clearstar High Yield USDC (Morpho Blue)

Risk: High (requested)

Links

App: https://app.morpho.org/arbitrum/vault/0x64CA76e2525fc6Ab2179300c15e343d73e42f958/clearstar-high-yield-usdc

Contract: —

Vaults fyi: —

Informal Support Indicator

Should Lazy Summer DAO proceed with drafting a SIP to onboard these markets to the Arbitrum USDC Fleet?

- [YES] - promote to SIP

- [NO] - needs more discussion