Thanks to everyone who joined our second SUMR Transferability Community Call!

This session focused on helping the community understand the SUMR token itself and what it represents, how locking works under Governance V2, and how value flows back to token holders through the Lazy Summer DAO ecosystem.

Below is a summary of the key discussions and takeaways for anyone who couldn’t make it ![]()

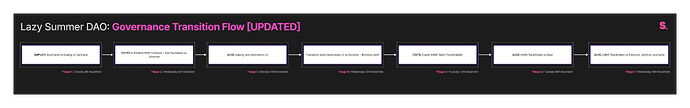

Newly published update on the Governance Transition Flow by @chrisb:

1. Context & Where We Are

We’re in the final stretch before SUMR transferability.

Governance V2 contracts including the new SUMR Lock Module and xSUMR/sSUMR governance token are undergoing final parameter review.

The Lazy Summer DAO will soon vote to whitelist these new contracts, after which SUMR transferability can move forward; first on Base, and later to mainnet and other supported networks.

As shared during the call:

“We’re getting close but we’re taking a careful, deliberate approach to make sure SUMR launches in a healthy, aligned, and community-driven way.”

2. SUMR and Its Purpose & Role

At its core, SUMR is the governance and coordination token of the Lazy Summer DAO.

It isn’t designed as a speculative asset, it’s the mechanism through which the community decides how value is distributed, how the treasury is used, and how the protocol evolves over time.

As Jordan framed it during the call:

“SUMR isn’t just something that votes, it’s a claim on the DAO’s future. The lock system gives holders a way to express long-term belief and alignment. The longer you commit, the more you share in the protocol’s success.”

This framing of participation through commitment underpins how SUMR connects the protocol’s business model to the value its users and token holders capture.

3. Locking & Governance Mechanics

Holders can lock their SUMR tokens to receive governance power and a part of the protocol earnings both in SUMR emissions and in stablecoin rewards from DAO earnings.

Key parameters:

- Lock Duration: From no lock (1x multiplier) up to 3 years (~7.26x multiplier).

- Rewards:

- ~5,000 SUMR/day total emissions.

- 20% of protocol revenue in USDC, distributed monthly via Merkl.

- Penalties: Early withdrawals are linearly penalized (up to 20%), with penalties sent to the Lazy Summer DAO treasury.

- Flexibility: Multiple lock positions can be created with different durations, and therefore reward profiles.

This design rewards conviction as governance weight and yield scale with long-term commitment, not short-term speculation.

As discussed on the call:

“Commitment drives influence, influence drives value, and value flows back to those who commit.”

4. Tokenomics Deep Dive

The SUMR token has a fixed supply of 1 billion, distributed through:

- DAO treasury holdings (~167M SUMR)

- Contributor allocations

- Governance incentives and liquidity programs

Emissions are modest and predictable, roughly 5,000 SUMR/day supporting sustainable governance participation without heavy dilution.

Value flow summary:

- Protocol generates yield from user deposits (both ETH and stablecoins — currently ~60% ETH by value).

- A portion (20%) of protocol revenue is directed to the SUMR Lock Module, rewarding lockers in USDC.

- SUMR emissions incentivize early participation and liquidity.

This structure links protocol performance to token utility, turning SUMR into what @samehueasyou described as a

“productive governance token one that gives governance both financial weight and responsibility".

5. Productive Governance & Business Model Alignment

A recurring theme in the discussion (led by @TokenBrice and @samehueasyou) was aligning how SUMR is communicated with the protocol’s business model; emphasizing productivity and real fundamentals over narrative hype.

Lazy Summer’s yield model means that value is both created for end users and captured for token holders through revenue sharing. That’s what makes SUMR productive: it represents governance over a system that continuously generates and distributes value back to those who steward it.

This framing will be integrated into future communications to help clarify how SUMR’s design mirrors the underlying economics of the protocol.

6. Marketing & Media Partner Program

@samehueasyou also presented the SUMR Media Partner Program a key component of the DAO’s transferability rollout strategy.

The goal is to amplify awareness of the transferability event and of Lazy Summer Protocol itself, through trusted, long-term content partners.

Highlights from the proposal:

- 3 tiers of partners (1-month, 3-month, and 6-month commitments).

- All partnerships are denominated in SUMR, with tokens distributed under vesting/lock schedules.

- Targeted total allocation: ~5–7M SUMR, including a bonus pool for partners who help onboard $100M+ in TVL.

- Unused funds flow back into the Lazy Summer DAO Treasury.

- Partners include well-known DeFi educators and creators with strong stablecoin and ETH-aligned audiences.

This ensures incentives are aligned and that messaging remains accurate, consistent, and value-focused.

“We want partners who believe in the story, who are aligned long-term and willing to take SUMR with a lock.”

7. Community Discussion & Q&A

Several great questions came up during the call, including:

- Can vault users (LV token holders) receive voting power too?

@TokenBrice and @Sixty explored the idea of giving partial governance weight to vault depositors, recognizing their role as core protocol participants.

The concept was well-received and could be revisited in a future governance discussion post-GovV2 launch, brought up to the forum as an RFC.

- Can I change my lock duration after depositing?

Not directly; you’d create a new lock position with the desired duration.

- How often are USDC rewards distributed?

Monthly, via Merkl, based on prior month’s protocol revenue.

- What happens if I unlock early?

A linear penalty (up to 20%) applies, sent back to the DAO treasury.

8. Next Steps

Short term:

- Complete Governance V2 parameter verification.

- Publish the Media Partner proposal for DAO vote.

- Prepare Merkl distribution setup.

Medium term:

- Execute on-chain votes to whitelist Lock and Governance modules.

- Begin SUMR liquidity preparation for Base launch.

- Finalize comms rollout with partner activation.

- Follow the proposed Governance Transition Flow.

Target: Transferability around November 18th, pending successful votes and final audits.

9. Closing Thoughts

As I said on the call:

“We’re entering the phase where SUMR becomes functional ownership; not just a token, but a tool for shaping how this ecosystem grows.”

The Lazy Summer DAO is moving from protocol to community-led governance, connecting yield, value, and participation through SUMR.

Keep an eye out for the Media Partner Program vote, Governance V2 verification, and the transferability launch announcement coming soon.

Every week brings us closer, so if you haven’t joined this time. Keep an eye out for the next community call, soon!