Hello, this is an supplementary proposal to SIP2.10 that onboarded superOETH to ETH as a Lower Risk Strategy (0xd9755f1541103333132e2c90c67f7e513060dc0e on BASE).

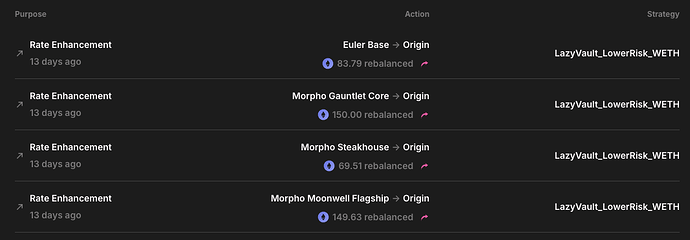

In the several weeks since the passing and execution of SIP2.10, the superOETH Ark has received several allocations of ETH and has since reached its TVL allocation cap:

The superOETH strategy Ark is currently outperforming all other allocated strategies in terms of live APY, with an allocation cap lower than all other allocated strategies.

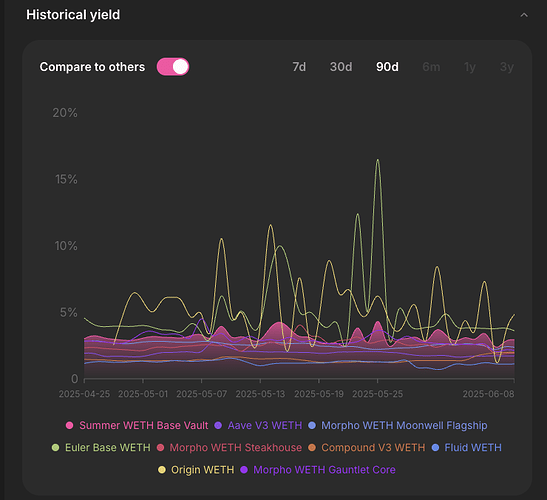

Historical yields over the past 90 days show that superOETH would have outperformed most other strategies as well:

I am proposing to increase the allocation cap of the superOETH Ark. Doing this will allow the vault’s AI to allocate more ETH from lower-performing strategies into the higher-performing superOETH Ark, which would increase the blended vault APY. If the vault were to allow up to 40% of the ETH to be allocated from the lowest performing strategy into the superOETH Ark, (using the numbers in the above screenshot from 2025-06-08 at 12.41.28 PM) the blended yield should increase to 3.4899% APY before the additional 19.82% SUMR rewards are added and accounted for.

If the vault were to allow up to a TVL allocation cap % of 78%, as per @BlockAnalitica recommendation, the blended yield of the vault would increase even further.