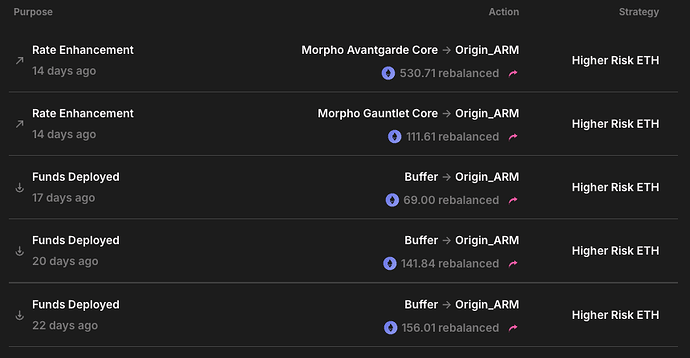

Hello, this is an supplementary proposal to SIP2.21 that onboarded the stETH ARM to ETH as a High Risk Strategy on Ethereum mainnet. In the several weeks since the passing and execution of SIP2.21, the stETH ARM Ark has received several allocations of ETH and has since reached its TVL allocation cap:

The stETH ARM Ark is currently outperforming all but 1 other allocated strategies in terms of APY, with a yield over 5%, but with an allocation cap lower than most other allocated strategies:

In the last month the stETH ARM has facilitated 61682.288 ETH in arbitrage volume, with the Morpho market integration generating yield for the days when the vault was unable to purchase stETH below peg:

Validator exit times are still 38 days + 8 days of sweep, so the Lido withdrawal times will blow out, along with the stETH peg, if there are a lot more withdrawals than deposits, which there appears to be:

For the next month at least, the ARM can accept a lot more ETH, double or even triple its current TVL, before yields start to compress. I am proposing to increase the deposit cap of the stETH ARM Ark. Doing this will allow the vault to allocate more ETH from lower-performing vault strategies into the higher-performing stETH ARM Ark, which would increase the blended vault APY, before the additional 11.80% SUMR rewards are added and accounted for.